Chapter 11 CVP Example - Cal Company

James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

Chapter 11 | MAAW's Textbook Table of Contents

The Cal Company produces pocket size calculators that are sold for $10 per unit. The costs associated with each unit are as follows:

Direct material $3.00

Direct labor $0.25

Variable overhead $2.00

Variable selling and administrative cost $0.75

Fixed manufacturing costs $100,000

Fixed selling and administrative costs $20,000

The company’s tax rate is 40%.

In a recent meeting, the board of directors asked the following questions. How many calculators do we need to produce and sell to accomplish each of the following requirements?

1. Break-even.

2. Earn net income before taxes of $40,000.

3. Earn net income after taxes of $24,000.

4. Earn a 20% return on sales before taxes.

5. Earn a 12% return on sales after taxes.

To answer these questions, we start by calculating the contribution per unit as follows:

Contribution margin per unit = P - V = 10 - (3 + .25 + 2 + .75) = 10 - 6 = 4.

Then, the five questions are answered by using the equations from Exhibit 11-1.

1. Break-even.

4X = 120,000

X = $120,000 ÷ 4 = 30,000 units.

2. Earn net income before taxes of $40,000.

4X = 120,000 + 40,000

X = 160,000 ÷ 4 = 40,000 units.

3. Earn net income after taxes of $24,000.

4X = 120,000 + [24,000 ÷ (1-.4)]

4X = 120,000 + 40,000

X = 160,000 ÷ 4 = 40,000 unit.

4. Earn a 20% return on sales before taxes.

4X = 120,000 + .2(10X)

4X = 120,000 + 2X

2X = 120,000

X = 120,000 ÷ 2 = 60,000 units.

5. Earn a 12% return on sales after taxes.

4X = 120,000 + [.12(10X) ÷ (1-.4)]

4X = 120,000 + .2(10X)

4X = 120,000 + 2X

2X = 120,000

X = 120,000 ÷ 2 = 60,000 units.

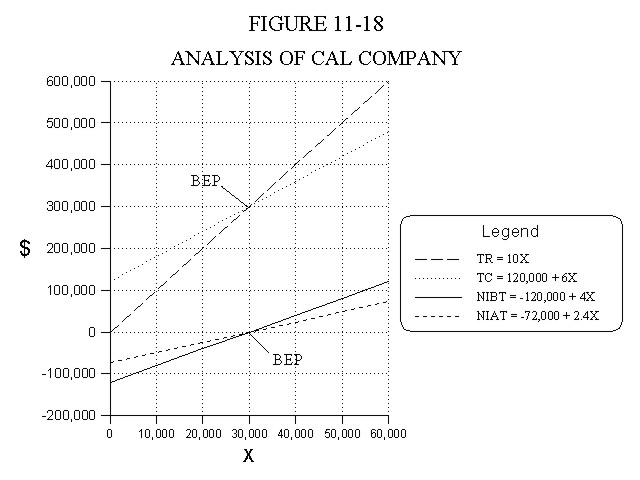

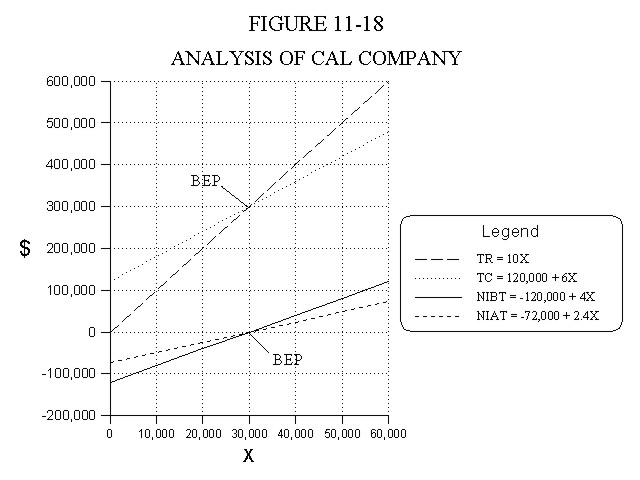

A graphic solution to Example 11-1 is illustrated in Figure 11-18.

Using The After Tax Equations As An Alternative

The equation for NIAT that appears in the graph is found by multiplying the equation for NIBT by (1-T) , i.e., (1-.4)(-120,000 + 4X) = -72,000 + 2.4X. Rearranging this equation we have 2.4X = 72,000 + NIAT. This revised equation indicates that the contribution margin after taxes ($2.4X) is equal to fixed costs after taxes ($72,000) plus the desired after tax income. It provides an alternative way to find the answers to questions 3 and 5 as illustrated below.

3. Earn net income after taxes of $24,000.

2.4X = 72,000 + NIAT desired

2.4X = 72,000 + 24,000

2.4X = 96,000

X = 96,000 ÷ 2.4 = 40,000 units.

5. Earn a 12% return on sales after taxes.

2.4X = 72,000 + NIAT desired

2.4X = 72,000 + .12(10X)

2.4X = 72,000 + 1.2X

1.2X = 72,000

X = 72,000 ÷ 1.2 = 60,000 units.

Checking the Solutions

The accuracy of linear cost-volume-profit calculations can be verified easily. For example, the answers to the questions above can be verified as follows:

1. Is 30,000 units the break-even point? Yes, since total contribution margin is equal to total fixed cost of 120,000, i.e., (4)(30,000) = $120,000.

2. Will 40,000 units generate a before tax profit of $40,000? Yes, because total contribution margin is (4)(40,000) = $160,000 and this amount is 160,000 - 120,000 = $40,000 above total fixed costs.

3. Will 40,000 units generate an after tax profit of $24,000? Yes, since (1-.4)($40,000 NIBT) = $24,000.

4. Will 60,000 units provide a 20% return on sales before taxes? Yes, since the NIBT is TCM - TFC or (4)(60,000) - 120,000 = $120,000. Sales equals PX or ($10)(60,000) = $600,000. R = 120,000 ÷ 600,000 = .20 or 20%.

5. Will 60,000 units provide a 12% return on sales after taxes. Yes, (1-.4)(.2) = .12 or 12%. For an alternative check (1-.4)(120,000) = $72,000 NIAT. Therefore, the after tax rate of return is 72,000 ÷ 600,000 = .12 or 12%.