Summary by James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

Pensions and Retirement Bibliography |

Small Business Main Page

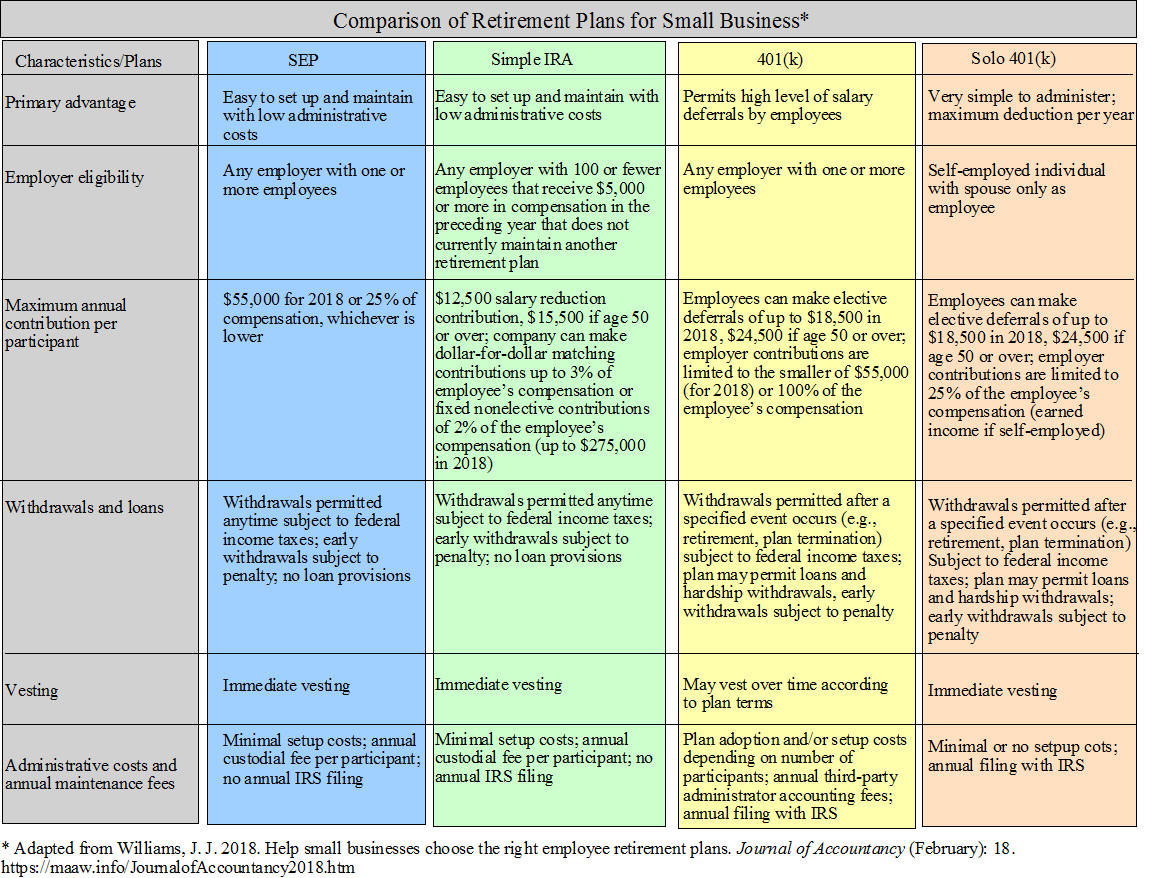

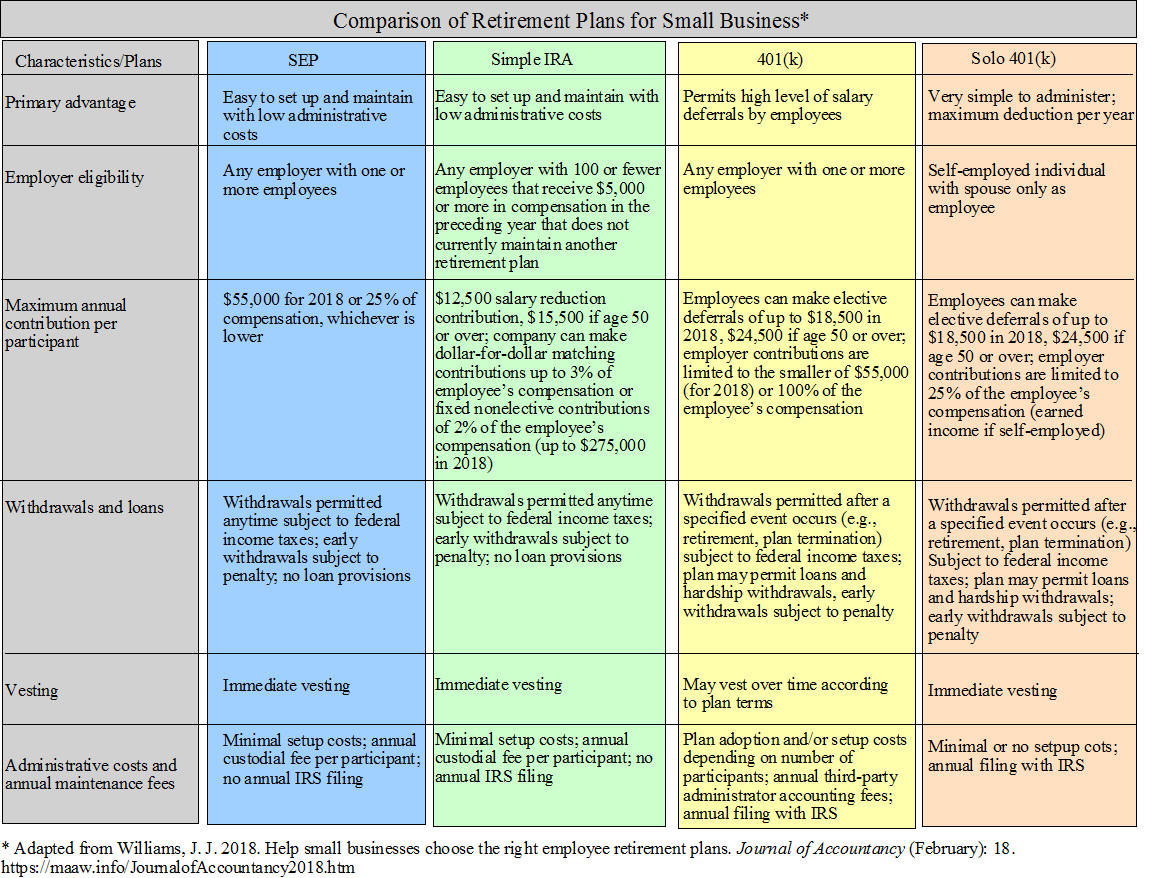

The purpose of this paper is to provide an overview of the types of retirement plans available to small businesses, as well as the issues to consider when choosing a plan. Williams discusses four types of retirement plans available to small businesses: SEP (Simplified employee pension), Simple IRA, 401(k), and Solo 401(k). A brief discussion of the key characteristics of the four plans is provided below.

Simplified Employee Pension (SEP) Plans - SEPs can be used by any employer, contributions are made by the employer only, and are limited to 25% of each qualified employee's compensation, or $55,000 for 2018. The contributions are tax-deductible as a business expense. Setup requires three steps: 1. Execute a written agreement to provide benefits to all eligible employees; 2. Provide employees with information about the agreement; and 3. Set up an IRA account for each employee. Employees are not allowed to defer income, but they are always 100% vested. The IRS has a form (5305-SEP) for this, but some employers must use a prototype document.

Simple IRA Plans or Savings Incentive Match Plans - Simple IRA plans are available to any employer with 100 or fewer employees who receive $5,000 or more in compensation during the year. Employer contributions are tax-deductible, and employee contributions are pre-tax. The IRS has two forms for this type of plan (5304-SIMPLE for non-financial institutions, and 5305-SIMPLE for financial institutions). Employees are allowed to defer income, and the employer's required contribution is smaller than with a SEP plan. However, the employer must match each employee's salary deduction up to 3% of the employee's compensation, or make a nonelective contribution of 2% of the employee's compensation up to $275,000 in 2018. Employees are always vested.

Qualified Plans

There are several types of qualified plans that are more complex than SEPs and Simple IRAs. These can be divided into two broad categories: Pension plans, also referred to as Defined Benefit Plans, and Defined Contribution Plans. Defined benefit plans generally require more administrative costs, and are not normally used by small businesses. Defined contribution plans include profit sharing plans and money purchase plans.

401(k) Plans - A profit sharing plan with a 401(k) feature is referred to as a 401(k) plan. Employee contributions are referred to as "elective deferrals". For 2018, participants can make elective deferrals up to $18,500 ($24,500 if age 50 or over at the end of the year). Employers can contribute to each employee's account, or match the employee's contribution, or both, but the total is limited to 100% of the employee's compensation, or $55,000 for 2018. Vesting depends on the terms of the plan that can include a graded vesting schedule (e.g., five year vesting), or cliff vesting, i.e., vesting after a specified number of years. 401(k) plans typically require a third-party administrator and include more administrative costs.

Solo 401(k) Plans - Solo 401(k) plans are offered by mutual fund and insurance companies, allow self-employed individuals to defer income, and have low administrative costs. Employees can make elective deferrals of up to $18,500, or $24,500 if age 50 or over. Employer contributions are limited to 25% of the employee's compensation and vesting is immediate.

Factors to Consider when Selecting a Retirement Plan

The first step in choosing a plan is to ask, Why does the business need a retirement plan? Is it to attract employees, promote employee retention, gain tax advantages, or some other reason. Other questions and considerations include:

Can the business afford the plan?

Who can contribute? Employees, employer, or both.

Eligibility - The number of employees and their eligibility.

Employee turnover and vesting period.

Contribution limits.

Administrative costs and requirements.

Need for a third-party administrator.

How can contributions be made and information be provided to participants?

Withdrawal limits, penalties, loans etc.

____________________________________________________

Resources:

Types of Retirement Plans. IRS. Types-of-retirement-plans

Choosing a Retirement Solution for your Small Business. IRS. IRS.gov