James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

Chapter 11 | MAAW's Textbook Table of Contents

The Gulf Company produces two products, A and B. The following sales prices, costs and product mix ratios are budgeted for 2000. (Note: all answers are rounded to whole units.)

| Product | Sales Price | Variable Cost per unit |

Sales Mix in Units |

Mix in Sales Dollars |

| A | $100 | $60 | 8/10 | 2/3 |

| B | 200 | 100 | 2/10 | 1/3 |

Total fixed costs are budgeted at $364,000 and the tax rate is forty percent.

1. The Gulf Company's conventional linear break-even point in total mixed units is

a. 840,000

b. 5,200

c. 866,667

d. 2,600

e. 7,000

2. Using conventional linear cost volume profit analysis, the number of units of A and B that Gulf Company needs to produce and sell to generate net income of $156,000 before taxes, based on the budgeted data above is

a. 10,000 of

each.

b. 8,000 A's and 2,000 B's

c. 800,000 A's and 400,000 B's

d. 2,400 A's and

600 B's

e. None of these.

3. Using conventional linear cost volume profit analysis, the total number of mixed units that Gulf Company needs to produce and sell to generate a twenty percent return on sales dollars before taxes based on the budgeted data above is

a.

1,560,000

b. 7,027

c. 11,375

d. 13,000

e. Some other number.

4. Now assume a tax rate of forty percent. Using conventional linear cost volume profit analysis, the total number of mixed units Gulf Company would need to produce and sell to generate a twenty-five percent return on sales dollars after taxes, based on the budgeted data given above is

a. 182,000

b. 16,545

c. 10,706

d. Some other number.

e. This problem is not feasible.

5. Assume the non-cash fixed cost (depreciation etc.) are $104,000. What is the before tax cash flow break-even point in total mixed dollars?

a. 624,000

b. 600,000

c. 440,000

d. 312,000

e. None of these.

6.What is the after tax cash flow break-even point in total mixed units?

a. 5,200

b. 5,000

c. 3,667

d. 2,600

e. None of these.

7. Which one of the following is not an assumption of conventional linear cost volume profit analysis?

a. Sales prices

are constant.

b. Input prices

are constant.

c. Units

produced equal units sold.

d. Total costs per unit are constant.

e. Productivity

is constant.

8. In conventional linear cost volume profit analysis, which of the following assumptions causes the total variable costs and total cost functions to be linear rather than nonlinear?

a. Sales prices

are constant.

b. Input prices

are constant.

c. Units

produced equal units sold.

d. Total costs

per unit are constant.

e. Productivity is constant.

9. A Company's cash flow break-even point would normally be

a. below the Company's conventional linear break-even point.

b. above the

Company's conventional linear break-even point.

c. the same as

the Company's conventional linear break-even point.

d. above or

below the Company's conventional linear break-even point depending on the

Company's tax rate.

e. none of

these.

10. Assuming sales are above the break-even level, the margin of safety multiplied by the contribution margin ratio is equal to

a. the sales

dollars above the break-even point.

b. the

contribution margin above the break-even point.

c. the net

income before taxes.

d. the net

income after taxes.

e. b and c.

11. Assuming sales are above the break-even level, the margin of safety multiplied by the contribution margin ratio multiplied by 1-tax rate is equal to

a. the sales

dollars above the break-even point.

b. the contribution margin above the break-even point.

c. the net

income before taxes.

d. the net income after taxes.

e. b and c

The following is a continuation of the

Brace Company problems in the Chapter 9 and Chapter 10 Extra MC questions.

Brace Company produces and sells a single product with budgeted or standard

costs as follows:

| Inputs |

Budgeted or Standard quantity per output |

Cost per input | Cost per output |

|

Direct materials Direct labor Factory overhead: Variable Fixed Total |

5 lbs 4 hours 4 hours 4 hours |

$10 9 11 20 |

$50 36 44 80 $210 |

Overhead rates are based on 5,000 standard direct labor hours per month or 1,250 units. Selling and administrative expenses include $40 per unit for variable costs and $50,000 per month for fixed costs. The budgeted sales price is $400 per unit. The tax rate is 40%. Round all answers to whole units.

12. How many units would Brace Company need to produce and sell to break even?

a. 1,154

b. 556

c. 714

d. 652

e. Some other number.

13. How many units would Brace Company need to produce and sell to generate a before tax profit of $126,000?

a. 1,200

b. 1,022

c. 1,453

d. 1,840

e. Some other number.

14. How many units would Brace Company need to produce and sell to generate a after tax profit of $126,000?

a. 1,200

b. 1,333

c. 1,565

d. 2,000

e. Some other number.

15. How many units would Brace Company need to produce and sell to generate an after tax profit equal to 12 percent of sales?

a. 1,667

b. 1,000

c.824

d. 540

e. Some other number.

16. Assume the JR Company has sales that generate a margin of safety of $200,000. If the contribution margin ratio is 30 percent and the tax rate is 40 percent, what would be JR's before tax net income?

a. 200,000

b. 60,000

c. 36,000

d. 24,000

e. Some other

number

17. What would be JR's after tax net income based on the situation in the question above?

a. 200,000

b. 60,000

c. 36,000

d. 24,000

e. Some other

number.

18. Which of the following represents a criticism of the linear cost volume profit approach from the activity based cost perspective?

a. It is based

on direct costing which is inconsistent with GAAP.

b. It assumes that production volume is the only cost driver.

c. It motivates

managers to overproduce to increase net income on external financial statements.

d. It ignores

quality.

e. None of

these.

19. Which of the following represents a criticism of the linear cost volume profit approach from the lean enterprise perspective?

a. It is based

on direct costing which is inconsistent with GAAP.

b. It assumes

that production volume is the only cost driver.

c. It motivates

managers to overproduce to increase net income on external financial statements.

d. It ignores quality.

e. None of the

above.

20. The non-linear theoretical cost volume profit model assumes that

a. total revenue increases at a decreasing rate.

b. total revenue

increases at a constant rate.

c. total revenue

increases at an increasing rate.

d. total revenue

increases at an increasing rate, then a decreasing rate.

e. None of

these.

The JIB Corporation produces and sells two products A and B.

| Product |

Contribution Margin per unit |

Budgeted sales mix ratios in units |

| A | $10 | .25 |

| B | 5 | .75 |

JIB has budgeted fixed manufacturing costs of $100,000 and budgeted fixed selling and administrative expenses of $20,000. The tax rate is 40%.

21. What is JIB’s breakeven point in mixed units?

a. 13,333

b. 16,000

c. 18,000

d. 19,200

e. None of these.

22. How many mixed units would JIB need to produce and sell to generate net income before taxes of $50,000?

a. 22,667

b. 25,500

c. 27,200

d. 32,533

e. None of these.

23. How many units of B would be in the mixed units needed to generate net income after taxes of $24,000?

a. 21,333

b. 19,200

c. 16,000

d. 12,800

e. None of these.

24. N Company produces and sells a single product N with a contribution margin ratio of .24. Total fixed costs are $60,000 and the tax rate is 40%. N Company’s break even point in sales dollars is

a. $60,000

b. $84,000

c. $250,000

d. $416,667

e. None of these.

25. N Company’s sales needed to generate after tax income equal to a 12% of sales dollars is

a.

$2,500,000

b. $1,500,000

c. 500,000

d. $357,143

e. None of these.

Now assume that N Company Developed a new product M and changed its name to M&N Company. Their two products have the following contribution margin and mix ratios.

| Product |

Contribution margin ratio |

Budgeted sales mix in Sales dollars |

| M | .20 | .35 |

| N | .24 | .65 |

Total fixed costs are now $90,400. The tax rate is 40%.

26. M&N Company’s break even point in mixed sales dollars is

a. $400,000

b. $410,909

c. $414,333

d. $821,818

e. None of these.

27. If M&N Company’s margin of safety is $100,000, net income after taxes would be

a. $9,600

b. $13,560

c. 13,800

d. $100,000

e. None of these.

28. Which one of the following is an assumption used in conventional linear cost volume profit analysis, but not an assumption used when developing a master budget?

a. Sales prices

are constant.

b. Input prices are constant.

c. Units produced equal units sold.

d. Variable costs per unit are constant.

e. Sales mix is constant.

29. In conventional linear cost volume profit analysis, which of the following assumptions causes the total variable costs and total cost functions to be linear rather than nonlinear?

a. Sales prices

are constant.

b. Input prices are constant.

c. Units produced equal units sold.

d. Total costs

per unit are constant.

e. Productivity is constant.

30. A Company's conventional linear break-even point would normally be

a. below the

Company's cash flow break-even point.

b. above the Company's cash flow break-even point.

c. the same as

the Company's cash flow break-even point.

d. a or b

depending on the Company's tax rate.

e. none of

these.

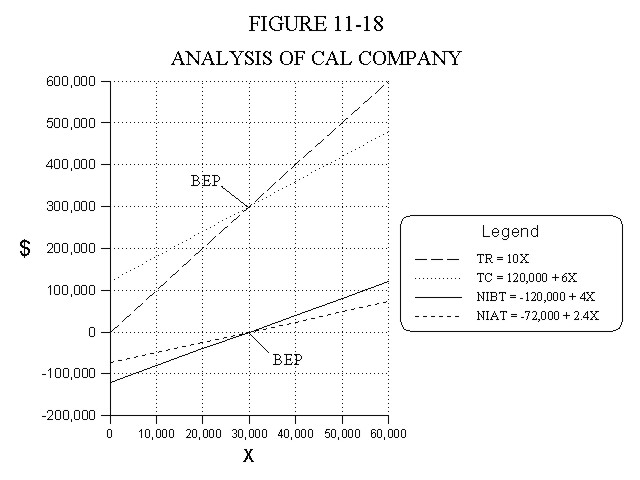

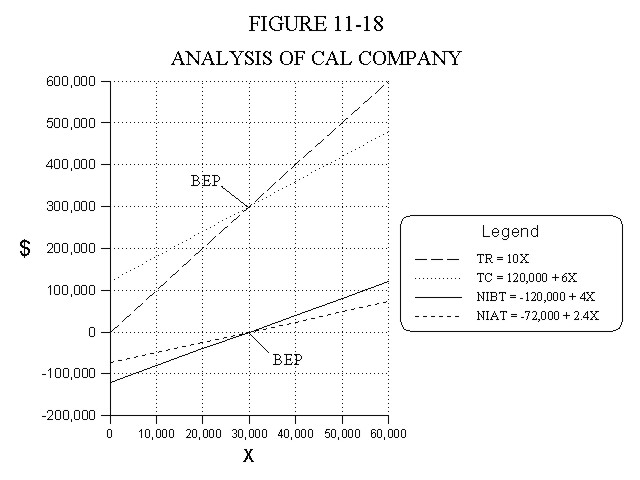

The following problem appears in Chapter 11. Assume that a firm produces and sells a single product with a sales price of $10 and unit costs as follows: Direct material = $3.00, Direct labor = $ .25, Variable overhead = $2.00, and Variable selling and administrative cost = $ .75. Total fixed costs are $100,000 for manufacturing and $20,000 for the selling and administrative functions. The tax rate is 40%.

31. What is the slope of the before tax profit (NIBT) function?

a. 4

b. -120,000

c. -120,000 + 4

d. -120,000 + 4X

e. None of these.

32. What is the slope of the after tax profit (NIAT) function?

a. -72,000

b. -72,000 + 2.4

c. -72,000 + 2.4X

d. 2.4

e. None of the above.

33. How many units would this company need to produce and sell to earn $30,000 in net income before taxes?

a. 7,500

b. 37,500

c. 42,500

d. 48,750

e. Some other number.

The Keso Company sells dozens of products that are conveniently grouped into two product lines, Hardware and Software. Budgeted contribution margin ratios and sales mix ratios are provided below.

| Product Line | Contribution Margin Ratios |

Sales Mix Ratios in Dollars |

| H S |

.70 .60 |

.60 .40 |

Total fixed costs are estimated to be $198,000.

34. The conventional linear break-even point in Sales dollars for product lines H and S based on the budgeted data given above is

a. 182,769 H's and 121,846 S's

b. 282,857 H's and 330,000 S's

c. 210,000 H's and 180,000 S's

d. Zero H's and 330,000 S's

e. 180,000 H's and

120,000 S's

35. Using conventional linear cost volume profit analysis, the budgeted net income before taxes that Keso Company would generate based on total sales of $500,000 is

a. 330,000

b. 200,000

c. 132,000

d. 2,000

e. Some other amount.

The Gulf Company produces two products, A and B. Information concerning budgeted sales prices, costs and sale mix is provided in the table below. (Note: all answers are rounded.)

| Product | Sales Price | Variable

Cost per unit |

Sales Mix in Units |

Mix in Sales Dollars |

| A | $100 | $60 | 8/10 | 2/3 |

| B | 200 | 100 | 2/10 | 1/3 |

Total fixed costs are budgeted at $364,000 and the tax rate is forty percent.

36. Assume the non-cash fixed costs (depreciation etc.) are $104,000. What is the before tax cash flow break-even point in total mixed sales dollars?

a. 624,000

b. 600,000

c. 440,000

d. 312,000

e. None of

these.

37.What is the after tax cash flow break-even point in total mixed units?

a. 5,200

b. 5,000

c. 3,667

d. 2,600

e. None of these.