Summary by James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

Organization Structure Main

Page | Platforms Bibliography

This article is based on the authors' 2019 book, The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power. The purpose of the article is to explain the evolution of platform companies, the different types of digital platforms and their business models, why some platforms generate growth and profits while others lose money, and to anticipate the trends that will determine platform success or failure in the future.

Platform Company Evolution

The first group of companies with digital platform strategies (Microsoft, Intel, Apple and IBM) disrupted the mainframe computer industry in the 1980s by providing a mass-market for personal computers. In the 1990s, Amazon, Google, Netscape, and Yahoo leveraged the internet to disrupt the retail, travel, and publishing industries. Alibaba, Tencent and Rakuten created similar disruptions in China and Japan. Somewhat later, Myspace, Friendster, Facebook, LinkedIn and Twitter used platforms to enable people and companies to interact. More recently, Airbnb, Didi Chuxing, Grab, and Uber have used platform strategies to launch the gig (sharing) economy. Today, platform companies that use digital technology to create self-sustaining feedback loops are in nearly every market. These companies become ecosystems of third-party firms and individual contractors that avoid the supply chains and labor pools required by traditional companies. However, they all face the same four challenges:

1. They need to determine which market participants they want to bring together (e.g., buyers and sellers, or users and innovators),

2. How to jump-start the network effects required for success,

3. Design a business model capable of generating a profit, and

4. Establish the rules for using and not abusing the platform.

Types of Business Platforms

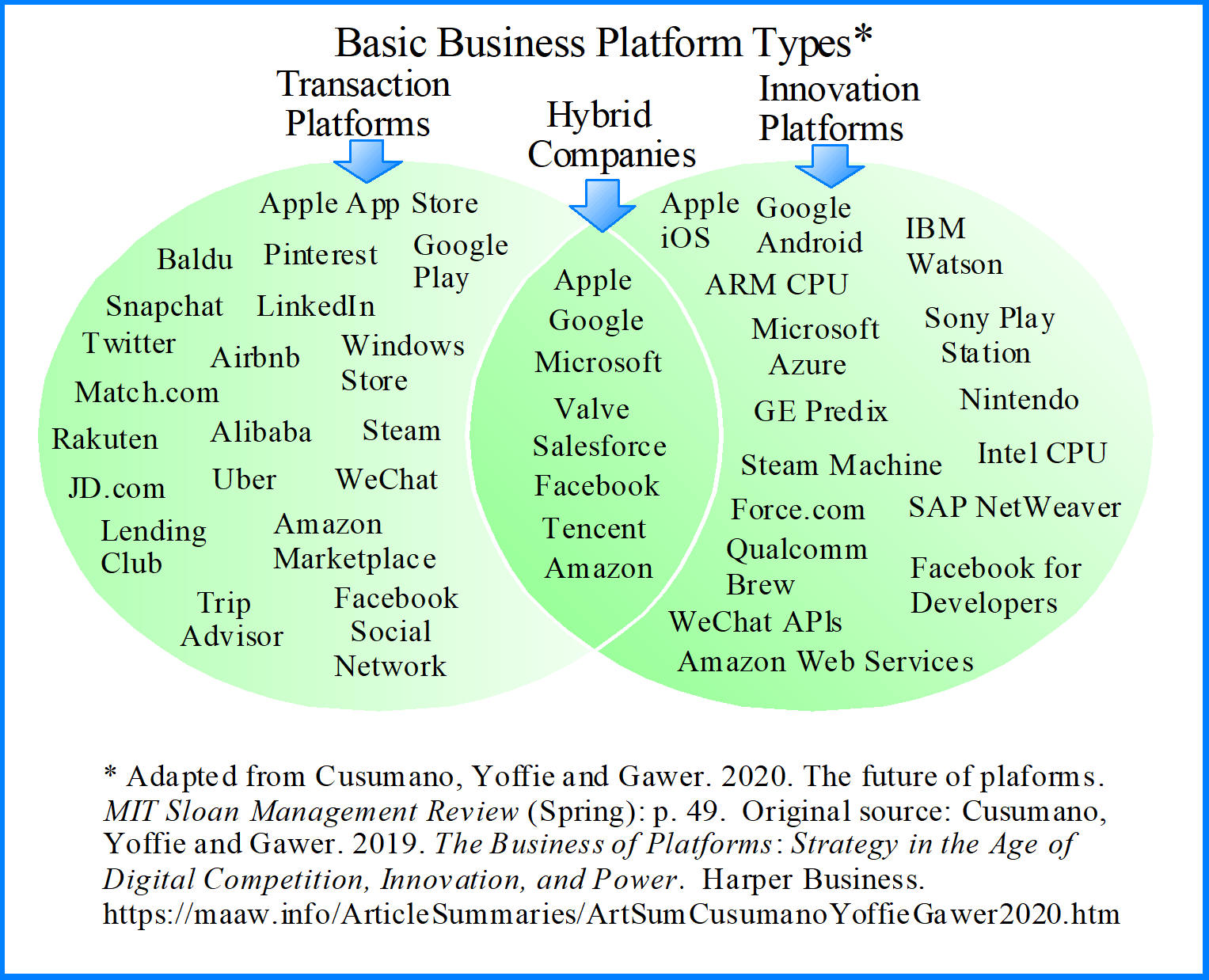

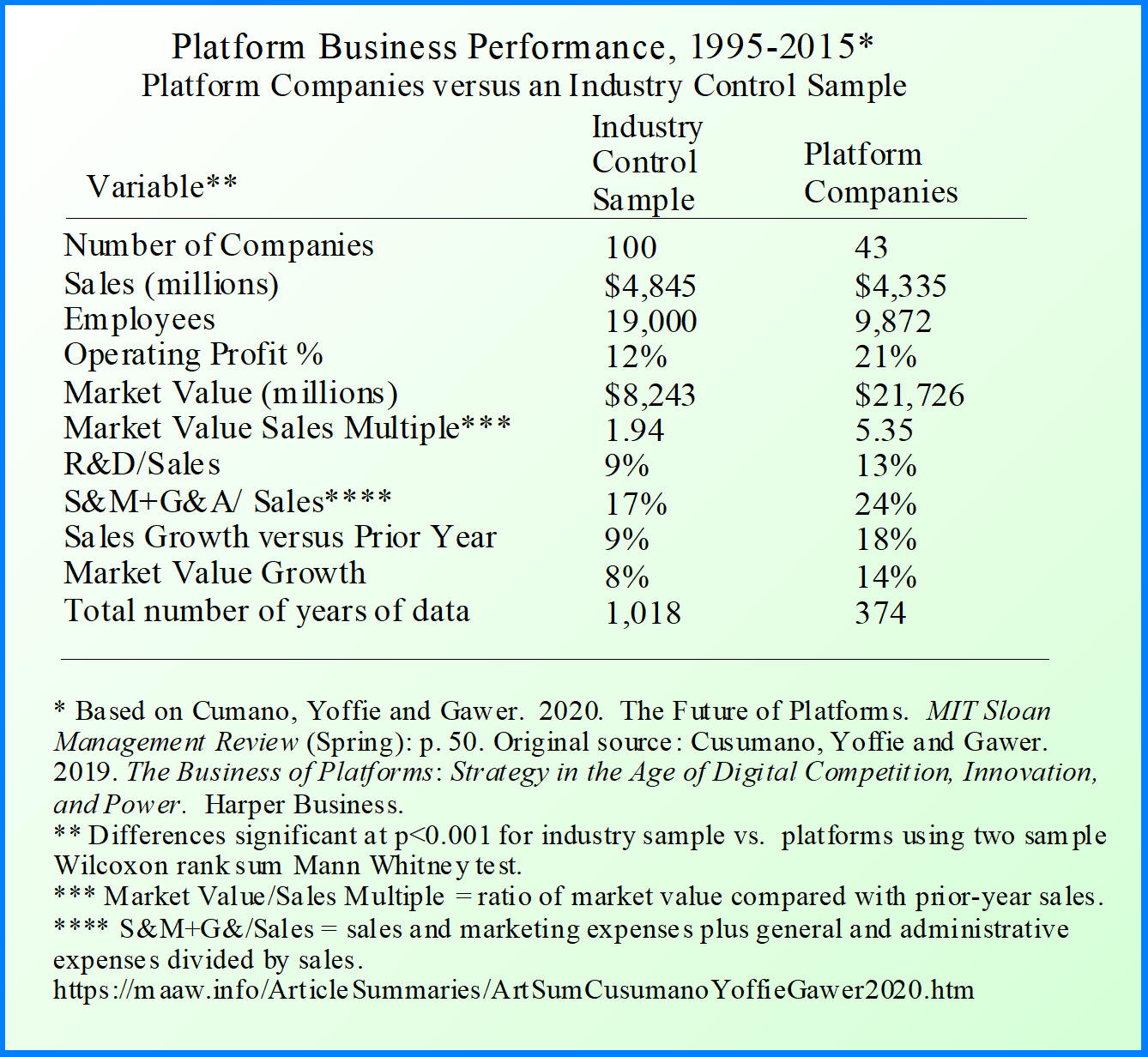

There are two basic types of business platforms based on their principle activity: transaction, and innovation platforms with some hybrid companies that combine both activities.

Transaction platforms serve as intermediaries or online marketplaces for participants to exchange goods, services, or information. The transaction platform captures value by collecting transaction fees or charging for advertising, and it becomes more valuable as the number of available functions and participants increases. Google Search, Amazon Marketplace, Facebook, Tencent's WeChat, Alibaba's Taobao marketplace, Uber, and Airbnb provide examples of some well known transaction platforms.

Innovation platforms provide for the development of new products or services that add functionality or assets to the platform, e.g., smartphone apps. They typically sell or rent a product, or provide it free and sell advertising or other ancillary services. Microsoft Windows, Google Android, Apple iOS, and Amazon Web Services provide examples of innovation platforms.

Hybrid companies contain both transaction and innovation platforms. The most valuable global companies like Apple, Google, Microsoft, Facebook, and Amazon integrate both types of platforms.

Platform Company Value

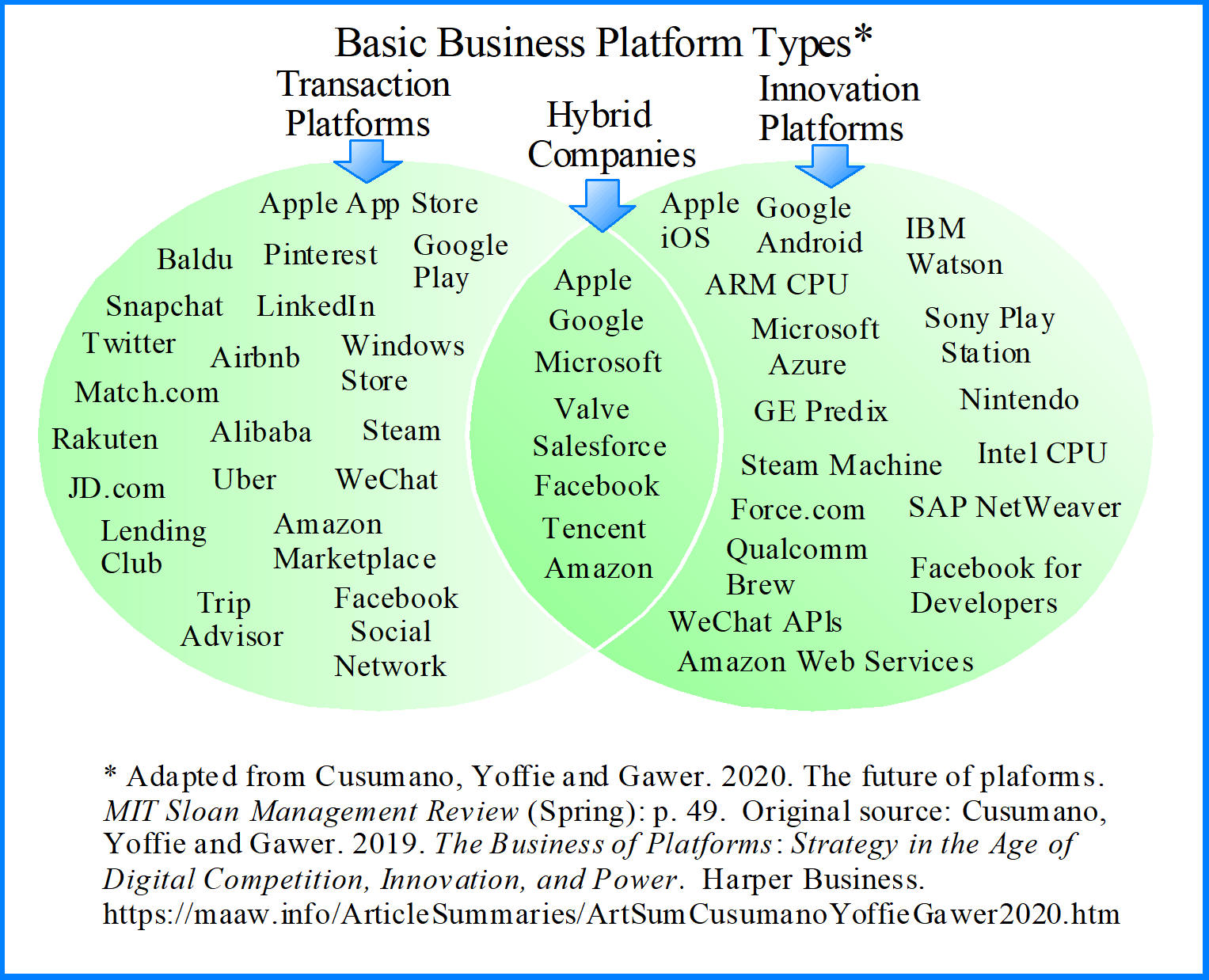

A comparison of the largest 43 publicly listed digital platform companies with a control sample of 100 non-platform companies revealed that platform companies achieve the same level of annual revenue with half the number of employees. The platform companies were twice as profitable, were growing twice as fast, and were twice as valuable as the conventional companies. However, creating a platform business is no guarantee of success. Many platform companies have failed because of mispricing on one side of the market, over subsidizing participants, or entering markets too late. PCs cannibalized mainframes, smartphones cannibalized traditional cellphones, and smartphones and the cloud are cannibalizing PCs.

Four Future Platform Trends

1. More hybrid business models. The hybrid business model will become the dominant model and strategy as the potential for digital technology and data competition increases.

2. More innovation. Advances in artificial intelligence, machine learning, and big data analytics will produce major improvements in platform operations and innovation. Capturing more data with improvements in cloud computing will likely enable a wide range of new applications such as voice interfaces and driverless cars.

3. More industry concentration. As multi-homing (where users and providers use multiple platforms) makes it increasingly difficult to attain dominant market shares and strong network effects, more platform concentration will occur.

4. More platform curation and regulation. Large platform companies will evolve into curated businesses with increasing government oversight. Growing scale and power means increased responsibility and regulation.

Three Emerging Platform Battlegrounds

1. Voice wars: Rapid growth, but chaotic competition. Machine learning has led to improvements in pattern recognition for images and voice. Apple's Siri and Amazon's Alexa provide examples in the war for platform domination now going on between Alibaba, Apple, Google, Microsoft, Tencent, and many other voice startups. How this platform war will evolve will depend on the ease of multi-homing. The platforms that produce the largest base of users and facilitate the most innovative applications will be the winners. Google has embedded its voice capabilities into millions of Android devices, while Amazon has millions of smart devices sitting in users' homes. These and other ecosystems that produce compelling voice solutions are likely to reduce multi-homing and competition from the other platform players.

2. Ride-sharing and self-driving cars: From platform to service. Artificial intelligence will enable capabilities that create, enhance, and destroy existing platform businesses. For example, Japan's SoftBank has invested $60 billion in 40 companies associated with self-driving cars (e.g., Didi, Grab, and Uber) betting that transportation platforms such as ride-sharing will eventually emerge as a highly concentrated, hugely profitable platform businesses. However, ride-sharing platforms are not fully digital businesses. Ordering and payment is digital, but the service is physical with network clusters that are local and limited in scale and scope. Price competition and multi-homing produces a low-margin business. A new model will likely emerge where ride-sharing platforms own or lease fleets of driverless automobiles that reduces the marginal cost of platform operation. This new model is counter to the two-sided model of matching riders with drivers and their cars, but consumers will likely benefit from less expensive ride-sharing, and companies will survive if they can generate enough capital and cash flow.

3. Quantum computers: A next-generation computing platform. According to an explanation on the IBM site, quantum computers leverage the quantum mechanical phenomena of superposition and entanglement to create states of scale exponentially. This allows the quantum computer to solve problems that today's computer systems will never be able to solve, e.g., new breakthroughs in science, medications to save lives, machine learning methods to diagnose illnesses sooner, and more innovative financial strategies for retirement. By 2018, dozens of universities, around 30 major companies, and many other startups had developed R&D efforts on quantum computing. Although quantum computers are difficult and expensive to build and program, they represent a revolutionary innovative platform for many new specialized applications as indicated above. Although these new platforms will not replace digital computers, they will likely face intense scrutiny and regulation because of their potential ability to break security keys that currently protect the world's information and financial assets. They may also be able to generate unbreakable keys to produce truly secure transactions and communication.

Platforms as Disrupters

In the future we will buy and own fewer products, contract for more services directly with one another and share through peer-to-peer transaction platforms with digital technologies such as blockchain. New cheaper technologies will gradually disrupt and overtake incumbents. In fact, industry wide platforms have already disrupted our lives as new innovation and transaction platforms have enabled nearly every type of activity one could imagine in today's world. Future platforms will surely inspire more innovation and disruption.

_______________________________

Related summaries:

Bonnet, D. and G. Westerman. 2021. The new elements of digital transformation: The authors revisit their landmark research and address how the competitive advantages offered by digital technology have evolved. MIT Sloan Management Review (Winter): 82-89. (Summary).

Johnson, M. W., C. M. Christensen and H. Kagermann. 2008. Reinventing your business model. Harvard Business Review (December): 50-59. (Summary).

Kavadias, S., K. Ladas and C. Loch. 2016. The transformative business model: How to tell if you have one. Harvard Business Review (October): 90-98. (Summary).

Magretta, J. 2002. Why business models matter. Harvard Business Review (May): 86-92. Explains the difference between a business model and a competitive strategy. (Summary).

Van Alstyne, M. W., Parker, G. G. and S. P. Choudary. 2016. Pipelines, platforms, and the new rules of strategy: Scale now trumps differentiation. Harvard Business Review (April): 54-62. (Summary).

Zhu, F. and M. Iansiti. 2019. Why some platforms thrive and others don't: What Alibaba, Tencent, and Uber teach us about networks that flourish. The five characteristics that make the difference. Harvard Business Review (January/February): 118-125. (Summary).