Summary by James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

Pricing Decisions Main Page |

Surveys Main Page

The authors begin by referring to two myths or assumptions related to the use of cost data in economics textbooks: 1. That full cost are irrelevant as a basis for pricing decisions, and 2. that historical costs rather than replacement costs are equally irrelevant. The purpose of this article is to report on the results of a survey related to the pricing methods of Fortune 1,000 industrial companies. Over 500 of those companies responded to the survey and the results do not support the assumptions that companies view full cost and historical cost as irrelevant.

Variable Cost Pricing vs. Full Cost Pricing

The theoretical microeconomic model illustrates that to maximize profits a firm should set prices where marginal revenue equals marginal costs. Fixed cost are not relevant in the economic model. (See Martin's Chapter 11 for more on the theoretical model). Since marginal cost is rarely available, many economist support variable cost pricing. An alternative to the economic model is Herbert Simon's satisficing model that assumes the primary objective of a firm is not to maximize profits, but instead to earn a satisfactory return on the assets employed. Simon's model supports the view that full cost pricing will provide a satisfactory return.

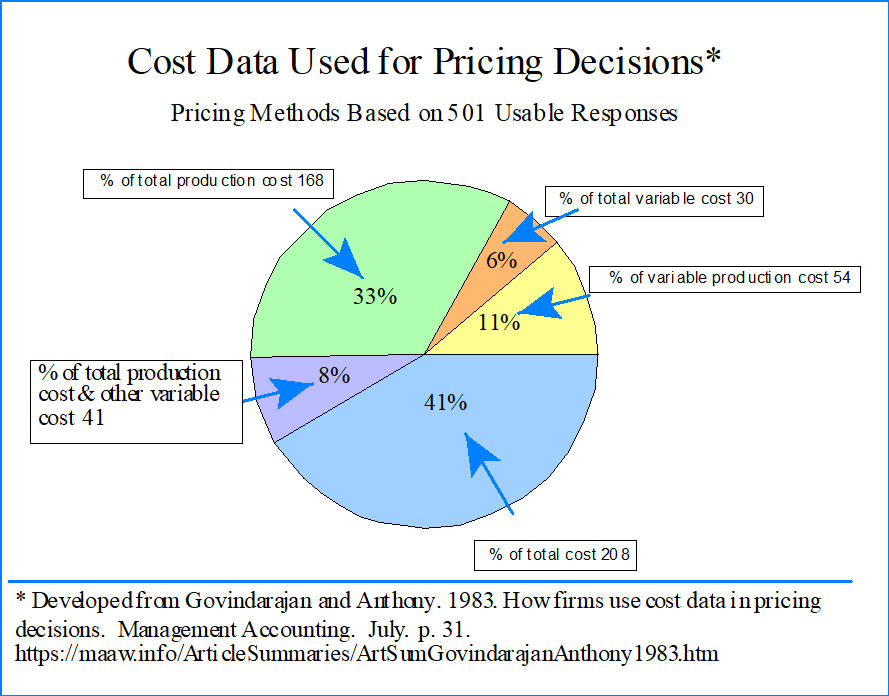

Table 1 and the pie chart below illustrate the survey results that show what industrial companies actually do in terms of pricing.

Out of 501 usable responses, 84 companies (17%) used variable cost pricing, and 417 companies (83%) used full costs as a basis for pricing products.

There are several reasons why managers use full cost pricing:

1. The economic profit maximizing model cannot be applied in most real world situations. Although the microeconomic model is mathematically sound, it does not provide a practical approach to the pricing decision.

2. The economic model requires the use of the law of supply and demand. Although the firm's supply curve can be estimated fairly well, the demand curve (quantity of product that can be sold at each possible price) is much more elusive.

3. In the economic model, price is the only element in the marketing mix, but many other factors are involved that complement the pricing decision, e.g., channels of distribution, and product quality.

Historical Costs vs. Replacement Cost

The economic model treats historical costs as sunk cost that are therefore irrelevant in pricing decisions. The economic view is that a company is not viable unless its selling prices are high to recover the replacement cost of the assets. Others argue that a company can operate satisfactorily if it recovers the historical cost of the assets. The answer to the question of which approach companies use was revealed by the firms responses to a question about their basis for depreciation costs, i.e., historical cost, current cost, or some other non historical cost method. The survey indicted that 425 companies used historical cost depreciation for typical pricing decisions. Only 24 companies reported the use of replacement costs.

There are several reasons why most companies use historical costs depreciation as a basis for pricing.

1. A company does not need to recover replacement cost to remain viable.

2. There is no reason consumers should pay for the cost of future assets. Replacement costs are the costs of producing future products, not current products.

3. Replacement cost pricing would be inflationary and would stimulate an inflationary spiral.

4. It is not necessary to earn profits above the firm's actual costs and cost of capital.

5. Many assets will not be replaced or will be replaced with different assets, so determining the replacement cost of the assets is problematic.

Challenges to the Results

Some might argue that the survey does not provide valid information about the actual costs used in pricing, and even if the results are valid they report on how managers act, not how they should act. To counter those potential criticisms of the survey results the authors used a large sample and tried successfully to obtain a high response rate. They also limited their conclusion to large industrial companies. If economics professors want to provide students with an idea of how pricing is done in practice they should explain that most companies use full cost rather than marginal or variable cost as a basis for pricing, and the depreciation included in those cost is based on historical cost rather than replacement cost.

________________________________________

Related summaries:

Abel, R. 1978. The role of costs and cost accounting in price determination. Management Accounting (April): 29-32. (Summary).

Bertini, M. and O. Koenigsberg. 2021. The pitfalls of pricing algorithms. Harvard Business Review (September/October): 74-83. (Summary).

Hinterhuber, A. 2008. Customer value-based pricing strategies: Why companies resist. Journal of Business Strategy 29(4): 41-50. (Summary).

Hinterhuber, A. and S. Liozu. 2012. Is it time to rethink your pricing strategy? MIT Sloan Management Review (Summer): 69-77. (Summary).

Hughes, S. B. and K. A. P. Gjerde. 2003. Do different cost systems make a difference? Management Accounting Quarterly (Fall): 22-30. (Summary).

Martin, J. R. Not dated. Chapter 11: Conventional Linear Cost-Volume-Profit Analysis. Management Accounting: Concepts, Techniques & Controversial Issues. Management And Accounting Web. (Chapter11).

Martin, J. R. 2022. A note on pricing strategies. (Note).

Porter, M. E. 1980. Competitive Strategy: Techniques for Analyzing Industries and Competitors. The Free Press. (Summary).

Shim, E. and E. F. Sudit. 1995. How manufacturers price products. Management Accounting (February): 37-39. (Note).

Shim, E. D. and R. Lim. 2022. A survey of U.S. firms' pricing strategies and costing methods. Cost Management (May/June): 15-19. (Note).

Thurston, K. L. D. M. Keleman and J. B. MacAarthur. 2000. Providing strategic activity cost information: Cost for pricing at Blue Cross and Blue Shield of Florida. Management Accounting Quarterly (Spring): 4-13. (Summary).