Summary by Erin Howry

Master of Accountancy Program

University of South Florida, Summer 2003

AIS/MIS Main Page | Responsibility

Accounting Main Page | Technology Main Page

Purpose: To understand how technology is changing the face of modern business and how it affects accounting, both internal and external, in practice at CPA firms, and in the classroom.

Changes being driven by IT and their effect on the needs for accounting information

To begin his discussion on how information technology is changing business, Elliott references Alvin Toffler’s image of the “third wave”. In The Third Wave, Toffler explains the three fundamental methods of wealth creation - agriculture, industry and information technology. Until about 8000 B.C., life consisted of foraging, fishing, hunting and herding. About 10,000 years ago, agriculture was developed and became the first major wealth creating technology. Agriculture stimulated the need for defense, government and laws since people were tied to the land that they cultivated and gave up the nomadic lifestyle. This led into the second wave of new technology, industry, where people realized that they could control energy and use it to amplify human labor in the factory. This change also had a huge impact on civilization. People relocated around the factories that they worked in, making the cities densely populated. This change also had the effect of creating a sophisticated marketplace for the exchange of goods. The third wave, the information revolution, can be traced to the 1950s when the transistor was invented and the first commercial computer was put to use. This era is distinctly different from the previous two. Physical labor was the driver behind the agricultural era and machines drove industry. In this third wave of wealth creation, information itself is the driver behind the system.

Each wave of wealth creation had certain characteristics of information technology. The IT for the first wave was writing, which was developed to keep accounting records. The IT for the second wave was movable type printing. This technology allowed for the mass production of books which were handwritten, thereby making information widely available. The IT for the third wave is the digital computer. The digital computer allows for the inexpensive storage and processing of information.

As the technology changed for each wave, so did accountability technologies. In the first wave, the agricultural era, single entry accounting was sufficient. The pace of the era was set by the annual agriculture cycle and owners only needed to count their assets and their obligations. The faster paced industrial era required a new method of accounting. Double entry bookkeeping, invented by Pacioli in 1494, was used where debits equaled credits. This system provided a convenient way of keeping track of a large number of contracts in various stages of completion. The assumption is that the third wave of technology will also demand a new accountability technology. Yuji Ijiri has proposed a system of triple entry accounting that is original and a major step in the right direction. The only problem with his model is that triple entry accounting still operates using the second wave concepts of assets, liabilities, revenue and expense. A new accounting methodology will need to break away from old measurements and measure what is relevant to the new information era. We are in a period of technological discontinuity that was not experienced by previous eras. Our need for a new accountability technology forces us to operate business in the third wave while continuing to use outdated second wave accountability technology.

IT is changing the face of business

Companies that utilize the available information technology have the ability to get closer to their customers. They also have the capabilities to increase the quality of their products. This increase in communication with the end user and improved quality capabilities are also allowing companies to move away from mass production and towards individual customization. Another unique feature of IT is that it allows management to effectively communicate and manage a business on a global scale.

IT is also changing the way managers function

Since we are in a period of technological discontinuity, business managers face different issues than those faced by industrial managers. The second wave manager operated an enterprise with a hierarchical organizational structure. Within that structure, managers tried to achieve some target rate of economic activity. The advantage of this structure is that a very large number of employees can be managed and controlled. The disadvantage of this structure is a lack of agility. The hierarchical organizational structure results in a stovepiped organization impeding the horizontal flow of information and facilitating vertical flows. This resulted in a type of halting behavior that caused an increase in production time from idea conception to product delivery. Managers of second wave companies had an easy task. They received an endowment of assets to operate and turn over to their successors unimpaired. Under Frederick Taylor’s principles of scientific management, managers determined a best way to do things using tools such as time and motion studies. The best way was then locked into the organization and control systems were developed to achieve the lock in.

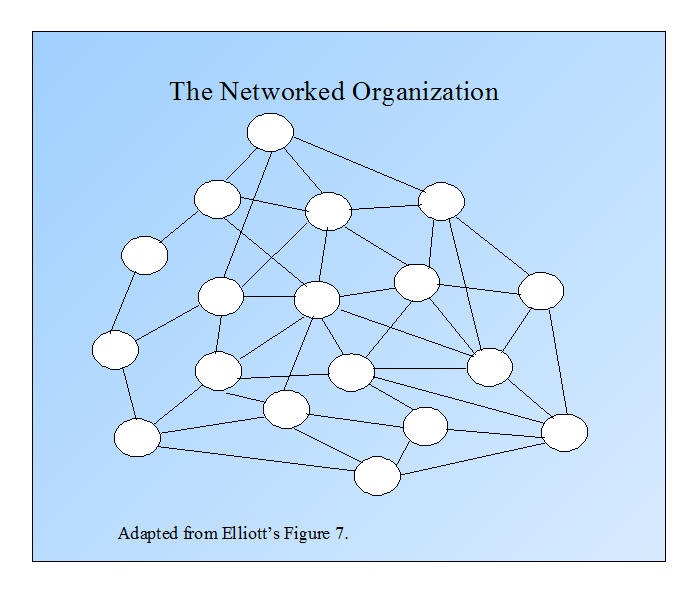

There is both a different organizational structure and a different set of managerial tasks for the third wave manager. The third wave organizational structure is networked. This structure allows two or more people to cooperate on any specific task at the same time utilizing the technology of wide area networks. This organization structure rapidly forms and reforms itself around a rapidly changing set of tasks.

When companies can break the functional stovepipe structure, product cycle time from conception to delivery can be drastically reduced. Organizational forms can be evaluated on their size and adaptability. The hierarchical structure can be as large as necessary but consequently move like sloths. The entrepreneurial form is flexible and nimble, but destined to remain small. The networked organization, however, can be large scaled while maintaining a sufficient level of agility.

Different demands are placed on third wave managers. In this new age, managers haplessly inherit an obsolescent basket of resources. Some examples include: a manager of a local firm, told he must now go global; a manager of an oversized firm, told he must downsize; or a manager of an electro-mechanical firm that must go solid state. Managers are also faced with the conversion of human resources from the old model to the new model. The old model consisted of white collar workers, the brains, telling the blue collar workers, the brawn, what to do. Their accounting systems measured whether the brawn did what they were told to do. The new model consists of knowledge workers from the plant floor to the executive offices. This shift in mentality allows for everyone to participate in quality improvement. To achieve these quality improvements, management must change production processes. This entails redesigning products and production processes, rather than just changing the input resources. The goal is to strive for ever improving quality. To accomplish this goal, managers in the third wave have new accounting technology needs.

Changes in business require changes in internal accounting information

Internal accounting information is decision supported information for use within the entity. During the second wave this type of information was known as managerial accounting information. This term conveys that the information is for the purpose of managing and controlling the organization. For the third wave, this term is imprecise since all workers are now known as knowledge workers. Information in the third wave is intended to empower all workers, not just managers, to continually increase quality.

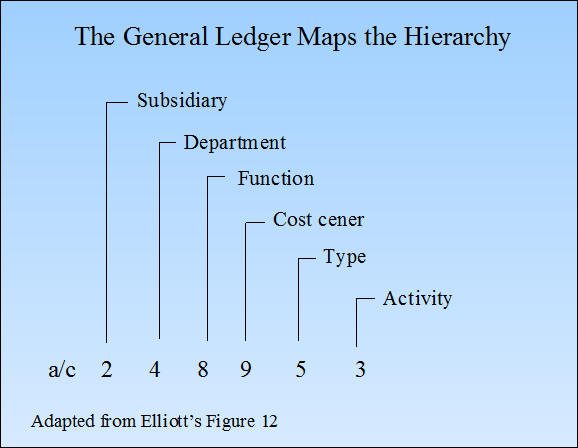

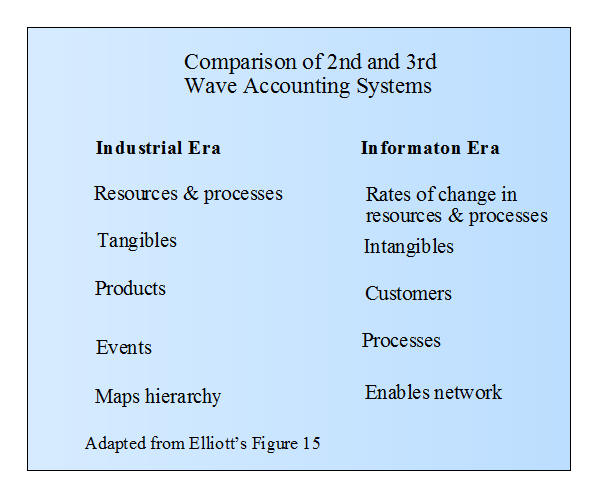

The second wave focused on measuring assets, liabilities, income and expense. It focused on tangible assets measured at cost. When transitioning into the third wave this causes a problem in that costs are on the production side, rather than value added, which is on the customer side. The second wave also postponed recording information until a transaction took place. This caused the accounting system to be based on events and focused on the past. The general ledger coding also locked in the tree structure of the organization. To obtain consolidated financial statements, managers could sort on the left digit. To obtain activity statements, they would sort on the right digit. This system of GL coding traps the organization in the second wave.

Elliott gives predictions for internal accounting information in the third wave. Third wave systems should focus on changes in resources and processes. Accounting should provide measures of transformation, including rates of change in resources and processes. The resources and obligations that are currently measured must also change. The resources that should be measured are information based assets such as R&D, human assets, knowledge, data, and capacity for innovation. The system must also be concerned with measuring the values created for the customers since the customer is the most important focus in the third wave. The system must enable the network rather than lock in hierarchy as the second wave does and it must also provide real time information. Elliott also proposes that transaction recording should be rethought to capture more information. Current IT makes these third wave accounting systems predictions possible. Current IT has the capability to support the changes Elliott proposes through the use of wide area networks and relational databases. Some characteristics of these technologies are: automated data capture, instantaneous access and processing, geographical freedom, fully versatile analysis and reporting, capacity for additional data types, and access to external data bases. The relational database concept provides that data can be added along any dimension. New types of data can be added to existing systems without altering existing uses and functions. Once the new data are added they can be used with the old data types to create new types of reports and analyses. Although many companies have access to wide area networks and relational database systems, most are not putting their use to their full potential. In order to reap the benefits of this technology, companies must put them to use.

Changes in business and new accounting needs require changes in external accounting

Like “management accounting”, “financial accounting” is a second wave term. It limits a reporting entity’s accountability only to financial information. Third wave entities have external accountabilities that go beyond financial information. These accountabilities represent accounting needs that call into question the efficacy of GAAP. Much of what users want to know is non-financial such as a company’s mission, goals, strategy, industry participation, competitive position, relative levels of quality compared to competitors, progress in product design and production cycle time reduction and productivity, and development of company’s human assets.

GAAP presents investors with periodic, historical, cost based statements; all indicative of second wave limitations. GAAP information is periodic which follows the annual first wave agricultural cycle. IT permits more frequent reporting. GAAP information is historical. Third wave users are concerned with the future more than the past. GAAP is cost based. Some would argue that mark to market is more relevant. GAAP is issued in statements, physical aggregations of data in a standardized form of paper. IT opens up numerous more possibilities for presentation. Due to the political nature of the governing bodies, it is not likely that GAAP will be changed anytime in the near future. Elliott states that while external reporting cannot currently be changed and internal reporting can, there are consequences in disconnecting the two. If standard setters are to break out of the second wave thought, they will have to think of new models that are not grounded on the simple transaction. IT permits persons doing business to engage in much more elaborate exchanges and keep track of them. Standards should be molded around the new concept of transaction.

Elliott lists implications for standard setters entering the third wave. They should, study the behavior of users, not just their stated preferences or their comments on GAAP. If they use non-GAAP information in attempting to predict future cash flows, assume it is useful. Study IT era internal information needs. Focus on third wave value drivers (information based assets and people). Focus on continuous rather than periodic information flows. Focus on measurements that signal change in the rate of change. Provide continuing service (consultation, education, software) to constituencies. Educate managements and users as to the third wave accounting paradigm.

Changes in business and new accounting needs require changes in public accounting firms

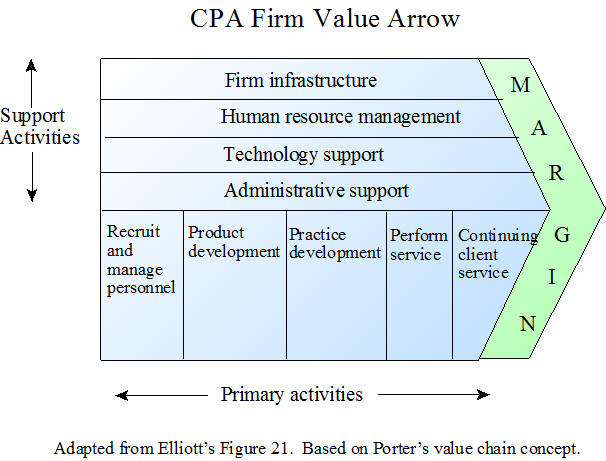

Public accounting firms have not adjusted to the third wave. The biggest challenge they face is that a majority of their practice is tied to historical cost based financial statements. Most accounting, auditing, and tax work is related to historical cost based financial statements. However, there is not a quick fix to this problem due to GAAP and tax law requirements. The organizational structure of CPA firms is still indicative of the second wave era. In order to better serve their clients, the firms must break out of their stovepiped structure.

The third wave creates new opportunities for the attest service. The technology of this era allows for production of vast new streams of information that demand attestation. The following conditions exist for attestation demand: (1) Users need the information, (2) there is a conflict of interest between the preparer and the user of the information, (3) the information is auditable, and (4) there is a favorable cost benefit ratio for attestation. Given the new streams of information possible by the third wave, the outlook is promising for expanded attestation services. Technology also provides the means to automate much of the attest process. Auditing technology provides more efficient and different means of attestation. Cheaper computing power, wide area networks and intelligent software all contribute to increased efficiency. CPAs now have the ability to access clients data real time and provide attest service on demand.

Non attest services can also benefit from the third wave of technology.

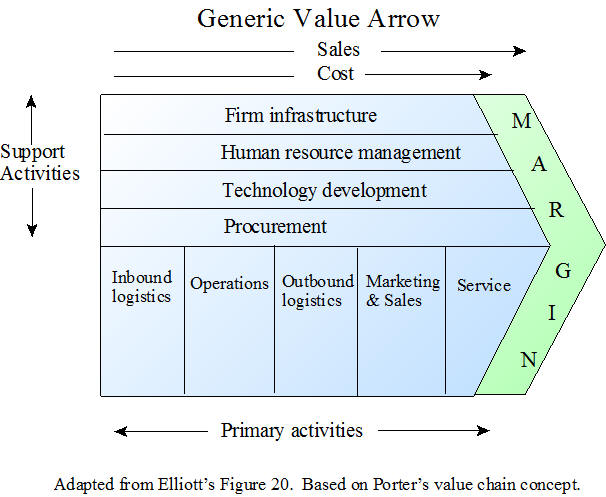

A review of Michael Porter’s value chain analysis* is beneficial to examine this area of the third wave. The overall length of the arrow represents total value created by the organization or revenue. The shorter length represents the costs incurred to generate revenue. The difference between revenue and cost is margin. There are two ways to increase margin, either through an increase in value to customers or by decreasing costs. The activities of the firms are mapped within the arrow. Primary activities are those which create value for customers. They are inbound logistics, operations, outbound logistics, marketing and sales, and continuing service. Supporting activities do not create value but are necessary to sustain the entity. They are firm infrastructure, human resource management, technology development and procurement.

How can CPA firms add value to their clients? CPAs traditional products, audits and tax compliance, are directed to the support activities of their client. Rather, they should focus on services directed to the strategic use of information to facilitate the primary value adding functions in the client’s organizations. Elliott maps four steps to achieve this goal: First, develop a fundamental understanding of the strategic value of information systems. Then, understand how the client’s primary value adding activities create value. Next, figure out how the client can create more value through the use of information and information systems. Finally, identify, coordinate and develop the resources in the firm to make it happen. In this new technological era, only then are CPA firms likely to flourish in the long term.

Changes in business and new accounting needs require changes in accounting education

Graduates are no longer entering second wave companies. From the American Accounting Association Bedford report (1986) – “The fundamental challenge to accounting educators…is how to identify an appropriate balance between a broad fundamental education and a sufficient accounting education is special fields.”

The curriculum must change. A new curriculum must integrate technology. Students should participate in a network and learn how organizations can increase value to their customers through the use of a network. The curriculum should give students an appreciation and understanding of globalism not just in one class but the issue should be addressed throughout the program. It also must teach an accounting model suitable to third wave circumstances.

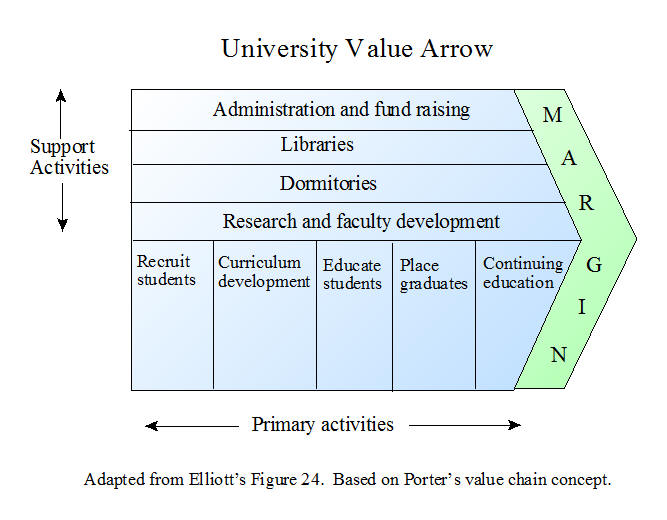

There needs to be a strategic planning model for higher education. Accounting departments and educational institutions must redesign their product and their delivery process. It is useful to return to Porter’s value arrow concept to analyze the value added activities that should take place at the university level and also at the student level.

Higher education is not organized to adapt its educational service to the third wave environment. Currently universities have a stovepipe structure and antiquated budgetary systems. Reforms to the current system require communication among the departments. It is hard to teach networking if the university is still on a stovepipe system. Ultimately market conditions will force higher education to stop looking only inward at the product and look outward at the value created for consumers. This means focusing on curriculum design, teaching methods and learning materials. Change is not a one time occurrence, it must be a continuous process.

Conclusion

“IT is creating a wave of change that is crashing over accounting’s shoreline. It crashed across industry in the 1970s. Then it crashed across the services in the 1980s. And it will crash across accounting in the 1990s. It is changing the way business is done and the new problems faced by managers. Managers now need new types of information in order to make decisions, so internal and external accounting must be changed. Higher education can simply react to these changes, or it can take a more active roll, embracing the future, adapting rapidly, and facilitating the adaptation of others. The challenge to academic accountants is to invent the third wave accounting paradigm and produce the graduates who can function effectively in the third wave organizations they will be joining. The challenge to nonacademic accountants is to make the organizational and political changes to implement the new accounting paradigm” (Elliott, 85).

_____________________________________________

* Porter, M. E. 1985. Competitive Advantage. The Free Press. (Porter's Generic Value Chain appears on page 37).

Related summaries:

Appelbaum, D., A. Kogan and M. A. Vasarhelyi. 2017. An introduction to data analysis for auditors and accountants. The CPA Journal (February): 32-37. (Summary).

Appelbaum, D., A. Kogan, M. Vasarhelyi and Z. Yan. 2017. Impact of business analytics and enterprise systems on managerial accounting. International Journal of Accounting Information Systems (25): 29-44. (Summary).

Bensaou, M. and M. Earl. 1998. The right mind-set for managing information technology. Harvard Business Review (September-October): 119-128. (Summary).

Bonnet, D. and G. Westerman. 2021. The new elements of digital transformation: The authors revisit their landmark research and address how the competitive advantages offered by digital technology have evolved. MIT Sloan Management Review (Winter): 82-89. (Summary).

Dolk, D. R. and K. J. Euske. 1994. Model integration: Overcoming the stovepipe organization. Advances in Management Accounting (3): 197-212. (Summary).

Hammer, M. 1990. Reengineering work: Don't automate, obliterate. Harvard Business Review (July-August): 104-112. (Summary).

Johnson, H. T. and A. Broms. 2000. Profit Beyond Measure: Extraordinary Results through Attention to Work and People. The Free Press. (Summary).

Martin, J. R. Not dated. 200 years of accounting history dates and events. Management And Accounting Web. AccountingHistoryDatesAndEvents.htm

Martin, J. R. Not dated. Responsibility accounting compared to other concepts: Summary exhibits. Management And Accounting Web. ResponACCSum.htm

Martin, J. R. Not dated. What is responsibility accounting? Management And Accounting Web. ResponsibilityAccountingConcept.htm

Martinsons, M., R. Davison and D. Tse. 1999. The balanced scorecard: A foundation for the strategic management of information systems. Decision Support Systems (25): 71-88. (Summary).

McNair, C. J. 1990. Interdependence and control: Traditional vs. activity-based responsibility accounting. Journal of Cost Management (Summer): 15-23. (Summary).

McNair, C. J. and L. P. Carr. 1994. Responsibility redefined. Advances in Management Accounting (3): 85-117. (Summary).

Parker, L. D. 1984. Control in organizational life: The contribution of Mary Parker Follett. The Academy of Management Review 9(4): 736-745. (Note).

Tiessen, P. and J. H. Waterhouse. 1983. Towards a descriptive theory of management accounting. Accounting, Organizations and Society 8(2-3): 251-267. (Summary).

Tschakert, N., J. Kokina, S. Kozlowski and M. Vasarhelyi. 2017. How business schools can integrate data analytics into the accounting curriculum. The CPA Journal (September): 10-12. (Summary).