Summary by James R. Martin, Ph.D., CMA

Professor Emeritus, University of South Florida

ABC Main Page | Cost Management Main Page |

Responsibility Accounting Main Page

The purpose of this paper is to show how organizational interdependence changes the assumptions underlying traditional responsibility accounting and how an activity based accounting system more closely matches the demands of interdependence. Interdependence is defined as "the integration of activities across functional and departmental lines". Management of organizational interdependence requires a more holistic approach to control than used in traditional responsibility accounting systems. What is needed is a control system that recognizes that mazimizing the performance of the subunits of an organization does not necessarilty maximize the performance of the whole organization.

Activity-Based Costing

Activity-based costing is defined as "a tool for analyzing cost flows and interdependence in complex manufacturing settings." It provides a basic part of the management control system where reported costs and highlighted activities can influence employee and organizational behavior.

Interdependence and the Organization

Traditional responsibility accounting systems provide buffers that allow activities to be decoupled so that they can be more efficient. However, this creates slack in the form of idle materials, excess handling, and excess storage. Managing interdependence involves removing the slack. The following graphic illustrates the impact of interdependence on time, structure, process, and control. In terms of time, the traditional focus was on individual output. Explicit recognition of interdependence shifts the foucs to throughput time rather than individual efficiency. Throughput time includes the activity time for moving, time in queue, setup, inspection, and processing. Structural changes include linking previously decoupled activities into cells that include both horizonal and vertical reporting. Processes are performed without traditional buffers to promote a stop and fix team oriented environment rather than the traditional run and sort approach. The focus of management control also shifts from individual efficiency to the effectiveness of groups with emphasis on self-motivation, group norms, and cooperation between indivdual workers.

Interdependence and Responsibility Accounting

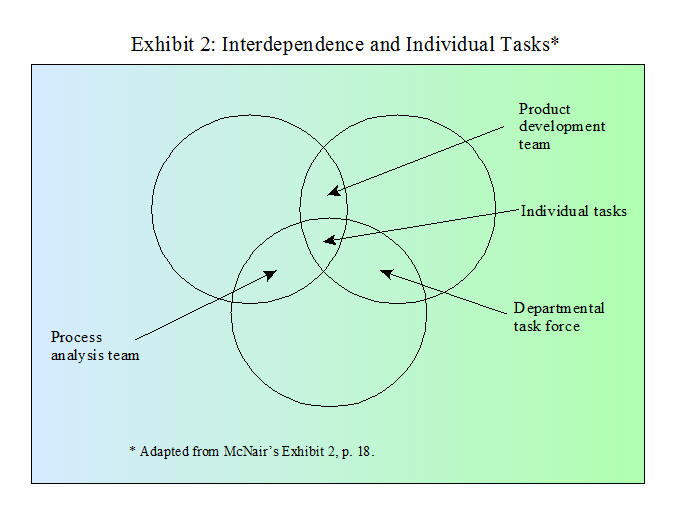

Traditional responsibility accounting uses budgets and variances to hold individuals responsible for those costs that they have the authority to incur causing them to manage cost rather than the activities that cause the cost. Activity-based accounting redefines accountability from costs to team-based activities. This shift to team-based activities and responsibility makes it more difficult to evaluate individual performance. Individuals perform various tasks that frequently change, and work on multiple teams with different team-based tasks and supervisors. The idea is conveyed in Exhibit 2 below.

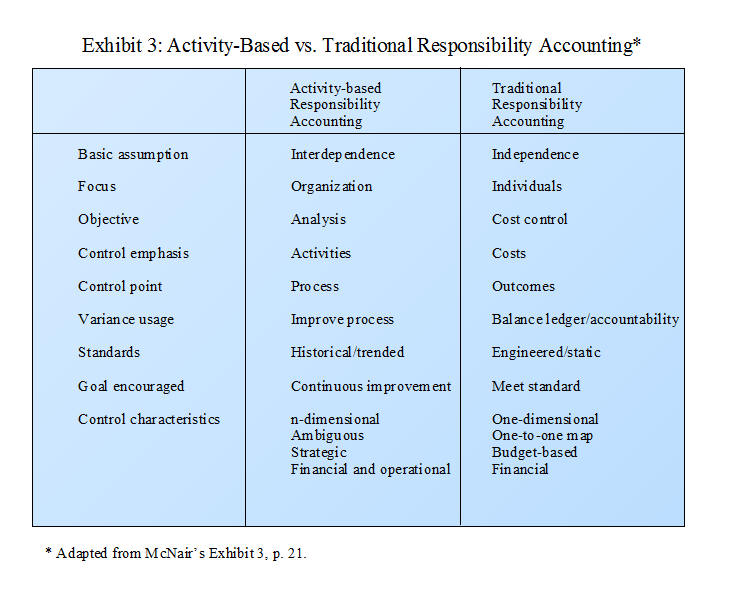

Exhibit 3 shows the major differences between traditional responsibility accounting and the activity-based approach that recognizes the need to manage interdependence. Explicit recognition of interdependence shifts management's focus from individual performance to the performance of the organization as a holistic system, from cost control to analyzing the activities that cause the costs, and from meeting engineered standards to continuous improvement in the trended performance of the process in both operational and financial terms.

McNair provides an example based on a company referred to as Computer Systems to show an integrated strategic approach. The company uses the SMART Performance Pyramid illustrated in the exhibit below. Customer defined external objectives such as quality, delivery, and flexibility are supported by internal activities and measurements that support these objectives. McNair also mentions a similar system used by Caterillar that is focused on activities and uses both financial and nonfinancial measurements.

Adopting a Database Approach

An Activity-based responsibility accounting system provides a database that identifies interrelated activities and the resources required. This results in a matrix form of accounting that replaces the rigid structure of the general ledger and supports decisions related to performance evaluation, product costing, and strategic planning. Exhibit 5 illustrates the data base approach to management control.

Activity-based responsibility accounting avoids the after-the-fact rationalizations, finger pointing, gamesmanship, defensive actions, and myopic behavior produced by traditional responsibility accounting. Using the new forms of activity accounting and control offered by ABC, managers can learn about the interrelationships and interdependences between activities, and change management's role in the organization.

___________________________________________

Related summaries:

Dolk, D. R. and K. J. Euske. 1994. Model integration: Overcoming the stovepipe organization. Advances in Management Accounting (3): 197-212. (Summary).

Elliott, R. K. 1992. The third wave breaks on the shores of accounting. Accounting Horizons 6 (June): 61-85. (Summary).

Greer, H. C. 1968. The chop suey caper. The Journal of Accountancy (April): 27-34. (Summary)

Hammer, M. 1990. Reengineering work: Don't automate, obliterate. Harvard Business Review (July-August): 104-112. (Summary).

Johnson, H. T. and A. Broms. 2000. Profit Beyond Measure: Extraordinary Results through Attention to Work and People. The Free Press. (Summary).

Martin, J. R. Not dated. Chapter 7: Activity Based Product Costing. Management Accounting: Concepts, Techniques & Controversial Issues. Management And Accounting Web. Chapter7.htm

Martin, J. R. Not dated. Responsibility accounting compared to other concepts: Summary exhibits. Management And Accounting Web. Respon ACC Summary

Martin, J. R. Not dated. What is responsibility accounting? Management And Accounting Web. Responsibility Accounting Concept

McNair, C. J. and L. P. Carr. 1994. Responsibility redefined. Advances in Management Accounting (3): 85-117. (Summary).

Mintzberg, H. and L. Van der Heyden. 1999. Organigraphs: Drawing how companies really work. Harvard Business Review (September-October): 87-94. (Summary).

Parker, L. D. 1984. Control in organizational life: The contribution of Mary Parker Follett. The Academy of Management Review 9(4): 736-745. (Note).

Rigby, D. K., J. Sutherland and H. Takeuchi. 2016. Embracing agile: How to master the process that's transforming management. Harvard Business Review (May): 40-50. (Summary).

Tiessen, P. and J. H. Waterhouse. 1983. Towards a descriptive theory of management accounting. Accounting, Organizations and Society 8(2-3): 251-267. (Summary).

Towry, K. L. 2003. Control in a teamwork environment: The impact of social ties on the effectiveness of mutual monitoring contracts. The Accounting Review (October): 1069-1095. (Towry discusses Social Identity Theory and how it can be applied to vertical and horizontal incentive systems). (Summary).