Summary by Velynda Wickerson

Master of Accountancy Program

University of South Florida, Fall 2004

Cost Allocation Main Page | Pricing

Decisions Main Page | Service Industry Main Page

In response to ever-increasing competition, the finance area of Blue Cross Blue Shield of Florida spearheaded the development of the Cost for Pricing (CFP) project during the early 1990’s. The expectation was that CFP would provide strategic activity cost information about products, customers, business segments, and activities. This cost information would then be used to identify:

The segments with the greatest profit growth potential,

The activities that are the most valuable to internal and external customers, and

The costs associated with non value-added activities.

The objectives of CFP are to organize the administrative expenses in order to provide the best tools and information to assist the cost managers in making decisions as well as build stronger, clearer relationships between the administrative cost centers, products and customers.

The company appointed corporate management teams to the CFP project, who identified three general purposes of each activity in the company: (1) to build or maintain a product, (2) to serve or sell to a customer, and (3) to perform general corporate duties. Furthermore, the teams recognized that all costs of these activities must be recovered through the amounts that are charged to the customers. Some of the company’s activity costs relate directly to specific products and customers while others are conducted in support of a broad category of customers, products, or even cost centers.

Nine categories of information requirements were identified (p.8):

Function,

Product,

Customer,

Funding arrangement,

Functional organization,

Delivery systems,

Regions,

Projects, and

Market segment.

The first three are fundamental categories and are expected to remain somewhat stable. The function category consists of 16 primary activities that are grouped according to tasks such as claims, subscriber accounting, and billing. The product category is very broad in nature. The customer category is also separated into broad groups except where specific customers need to be monitored.

The CFP process begins with the recognition of cost centers (approximately 600) and the assignment of costs to those cost centers. Usually, a cost center is organized around similar tasks, customers, or products. The cost center managers prepare their annual budgets, estimating how much they will spend performing their planned work and then monitor their performance against those budgeted amounts. Expenses are classified as unallocated expenses until they are redistributed to products and customers.

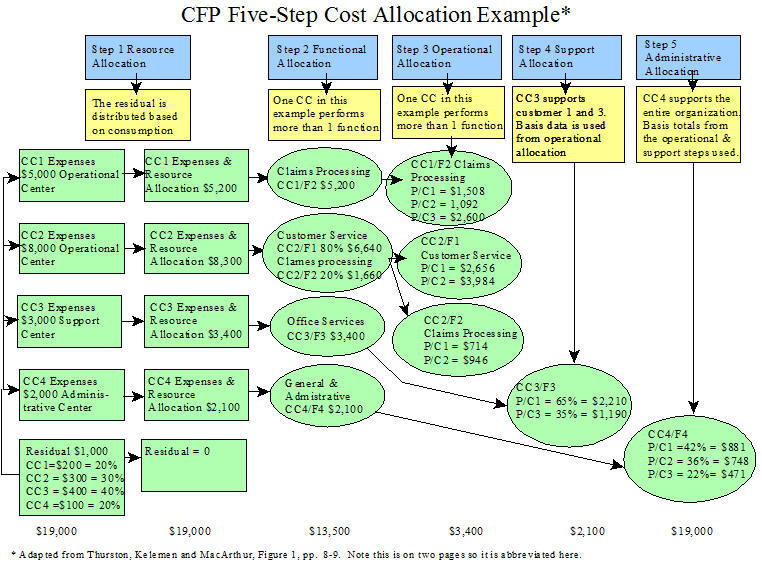

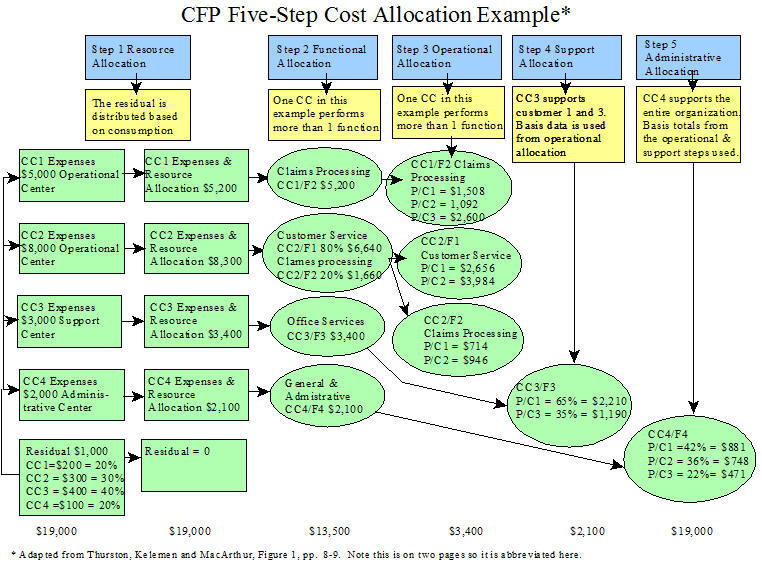

CFP is a lot like activity-based costing, organized into a five-step cost assignment process. It involves a functional allocation (Steps 1 & 2 of Table 1) and a four-step ROSA allocation (Steps 1, 3, 4, and 5 of Table 1) process. ROSA stands for the following:

Resource represents the internal or intracompany costs such as rent, postage, telephone, and are distributed to the cost centers that use the service or supplies,

Operational relates to cost center functions that can identify specific recipients,

Support relates to cost center functions that cannot identify specific recipients of their service but that can identify what entity or entities they support, and

Administration relates to cost center functions that cannot identify the recipients they serve or they support the entire organization.

A major advantage of cost for pricing (CFP) is the timeliness of the information. CFP also provides customized reports to managers, inexpensively. Various levels of management use CFP information in a variety of ways. Senior leadership uses CFP to make decisions related to strategic goals such as market share; whereas, segment managers use CFP to make decisions related to their profit and performance. CFP also allows functional leadership and cost center managers to manage and lower administrative expenses and develop improvement programs. Each management level uses a different set of cost drivers depending on their needs.

Since its implementation in 1996, CFP has been a dynamic, ever-changing, flexible management tool that BCBS of Florida has found quite useful in ultimately obtaining and maintaining their corporate objectives of financial strength, market share, and excellent customer service.

_______________________________________________

Related summaries:

Brimson, J. A. 1998. Feature costing: Beyond ABC. Journal of Cost Management (January/February): 6-12. (Summary).

Carter, T. L., A. M. Sedaghat and T. D. Williams. 1998. How ABC changed the post office. Management Accounting (February): 28-32, 35-36. (Summary).

Hughes, S. B. and K. A. Paulson Gjerde. 2003. Do different cost systems make a difference? Management Accounting Quarterly (Fall): 22-30. (Summary). (Note: 62% of the companies in this survey indicated that they set their selling prices based on market prices, 14% based on competitive bidding, 17% based on cost-plus, and 6% based on contribution margin).

Kaplan, R. S. 1990. The four stage model of cost systems design. Management Accounting (February): 22-26. (Summary).

Krumwiede, K. R. 1998. ABC: Why it's tried and how it succeeds. Management Accounting (April): 32-34, 36, 38. (Summary).

MacArthur, J. B. and H. A. Stranahan. 1998. Cost driver analysis in hospitals: A simultaneous equations approach. Journal of Management Accounting Research (10): 279-312. (Summary).

Martin, J. R. Not dated. Activity based management models. Management And Accounting Web. (ABM Models)

Martin, J. R. Not dated. Chapter 7: Activity Based Product Costing. Management Accounting: Concepts, Techniques & Controversial Issues. Management And Accounting Web. (Chapter7).

Porter, M. E. 1980. Competitive Strategy: Techniques for Analyzing Industries and Competitors. The Free Press. (Summary).

Ruhl, J. M. and B. P. Hartman. 1998. Activity-Based Costing in the Service Sector. Advances in Management Accounting (6): 147-161. (Summary).

West, T. D. and D. A. West. 1997. Applying ABC to healthcare. Management Accounting (February): 22, 24-26, 28-30, 32-33. (Summary).