Summary by William Beck

Master of Accountancy Program

University of South Florida, Summer 2002

PLC Main Page | Target Costing Main Page

The purpose of this article is to show the need for management accountants to be involved in the earliest stages of the product development process. The authors indicate that between 75% and 90% of product costs are predetermined during product development and that management accountants must be involved in this process to effectively assist in controlling costs. The authors conducted interviews and focus groups with about 20 top manufacturers from different industries and 12 consultancies who provide design services under contract to these types of companies.

Stages of Product Design.

The authors illustrate the changes that have taken place in the manner companies conduct their product development activities. Product design used to be a sequential method where the product was “thrown over the wall” from one department to another. The authors used a similar illustration to the one below to illustrate this method:

Product development has moved away from this sequential approach, with different departments in a company working independently, to an integrated team approach that includes the involvement of members from all functional areas of the business working together through the stages of the product life cycle. The new product development process can be illustrated as follows:

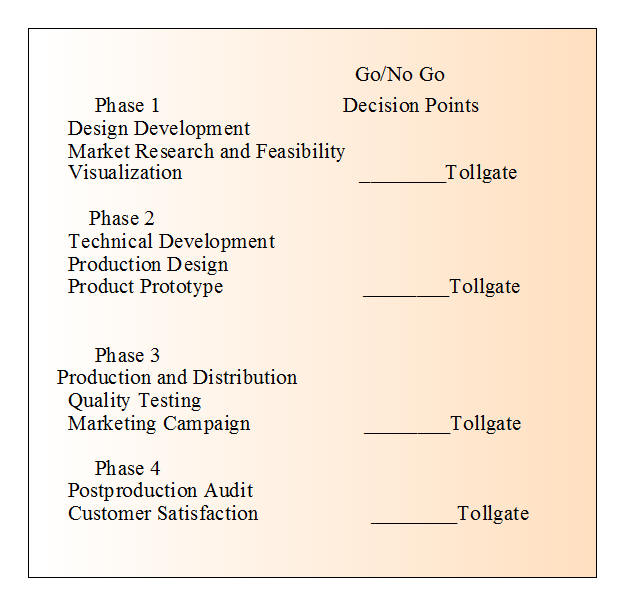

The authors refer to a “toll gate” process where members of the team and senior management assess various aspects of the product between each stage to determine if the continuation of the process is warranted. Through interactions among the management accountant and members from other functions, the team can ensure the proper balance between costs and other important product characteristics such as quality, function, appearance, and manufacturability (p. 50). The role of management accountants on these teams will be to act as “decision support specialists” and requires that they understand the interrelationship of the financial function with marketing, engineering, production, and other functions.

Responsibilities of Management Accountants

Management accountants can assist in the product development process in a number of ways. One responsibility of management accountants is in determining the financial feasibility of the product during the conceptual phase by developing cost estimated based on the designers ideas. Another responsibility was to help the team anticipate and develop financial information, for example, product cost estimates or projections of required investment, that would be necessary to obtain approval at the successive go/no go decision points called “tollgates” (p. 51). Management accountants are also valuable in the development of capital proposals needed to gain approval for the purchase or development of new equipment required for production of the products. Management accountants are also helpful in framing the cost-benefit discussions that need to take place between the product development team and senior management to move the product through the development process. Management accountants also act to remind team members that the cost of a product and its financial success are key goals the product design must satisfy. Finally, management accountants are also in the position to estimate not only initial product costs, but also costs to the distributor, consumer, and manufacturer over the entire life of the product.

The authors briefly discuss the controversy surrounding target costing in the product development process. One view of this is that strict target costing may decrease the creativity needed in the development process. They state that while designers frequently envision new features of a product that add cost, they simultaneously differentiate the product from the competition and add value in the minds of the consumer. The apposing view point is that target costing forces designers to look at alternative and innovative ways to meet their cost target.

Developing a New Role

To participate effectively in the product design process at the earlier stages, management accounting needs to undergo a number of changes including becoming more creative, proactive, and developing more flexible approaches to costing and financial analysis. One party interviewed stated management accountants need to become “more relaxed, more collaborative, and more service oriented.” Another of the persons interviewed stated that management accountants need to “become more diagnostic,” and that as a member of the cross-functional team they must “assess available data and help the team understand financial problems and possible solutions. The management accountant must truly understand the financial side of design.” There is also a need for further emphasis on “what if” analysis requiring management accountants to become more flexible than their traditional “exact data leading to exact answer” view. Finally, management accountants must also develop interpersonal skills needed to be an effective part of the team during the creative process.

Structuring the Management Accountant’s Role

Companies face many choices in determining how to use management accountants in the product development process. One method is to assign a management accountant from the financial department to each new product team. The benefit of this approach is that it is simple, however each new accountant brought on to the individual teams would have to go through the same learning process associated with working in this environment. A second method is to assign a management accountant to work in industrial design, while retaining a direct reporting relationship with the financial function of the business. Using this method would allow for the accountant to draw on knowledge from past experiences in the product development process and apply this knowledge to future projects. A third method is for the industrial design function to hire its own management accountants who would be responsible for assisting in the product development process.

Measuring Design Performance

Managerial accountants need to develop financial and non-financial measures to assist in the evaluation of new product development. Traditional methods of performance evaluation focused entirely on financial measures such as sales, cost, or profits. While these measures were useful in evaluating the performance of the product, they offer no insight into the performance of the various functions of the product development life cycle. Managerial accounting needs to develop methods of performance evaluation that focus on the specific functions in the product development process, so efforts can be focused on the areas that need improvement. Development of effective and appropriate performance measures of design performance can facilitate establishing and sustaining competitive advantage.

________________________________________________

Related summaries:

Adamany, H. G. and F. A. J.Gonsalves. 1994. Life cycle management: An integrated approach to managing investments. Journal of Cost Management (Summer): 35-48. (Summary).

Artto, K.A. 1994. Life cycle cost concepts and methodologies. Journal of Cost Management (Fall): 28-32. (Summary).

Berliner, C., and J. A. Brimson, eds. 1988. Cost Management for Today's Advanced Manufacturing: The CAMI Conceptual Design. Harvard Business School Press. (Summary).

Clinton, B. D. and A. H. Graves. 1999. Product value analysis: Strategic analysis over the entire product life cycle. Journal of Cost Management (May/June): 22-29. (Summary).

Czyzewski, A. B. and R. P. Hull. 1991. Improving profitability with life cycle costing. Journal of Cost Management (Summer): 20-27. (Summary).

Hayes, R. H. and S. C. Wheelwright. 1979. Link manufacturing process and product life cycles. Harvard Business Review (January-February): 133-140. (Summary).

Hayes, R. H. and S. C. Wheelwright. 1979. The dynamics of process-product life cycles. Harvard Business Review (March-April): 127-136. (Summary).

Martin, J. R. Not dated. Product life cycle management. Management And Accounting Web. PLCSummary.htm

Moores, K. and S. Yuen. 2001. Management accounting systems and organizational configuration: A life-cycle perspective. Accounting, Organizations and Society 26(4-5): 351-389. (Summary).

Rigby, D. K., J. Sutherland and H. Takeuchi. 2016. Embracing agile: How to master the process that's transforming management. Harvard Business Review (May): 40-50. (Summary).

Shields M. D. and S. M. Young. 1991. Managing product life cycle costs: An organizational model. Journal of Cost Management (Fall): 39-51. (Summary).